Here are some charts that reflect our areas of focus this week at XLU Leads with New High Even though the Utilities SPDR (XLU) cannot keep pace with the Technology…

Stocks

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced since the April lows, all have been…

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 and all the way back again. Over…

Tech Taps the Brakes, Homebuilders Hit the Gas: See the Rotation on StockCharts Today

The stock market feels like it’s holding its breath ahead of Big Tech earnings. The first two days of the trading week were mostly quiet, but Tuesday gave us a…

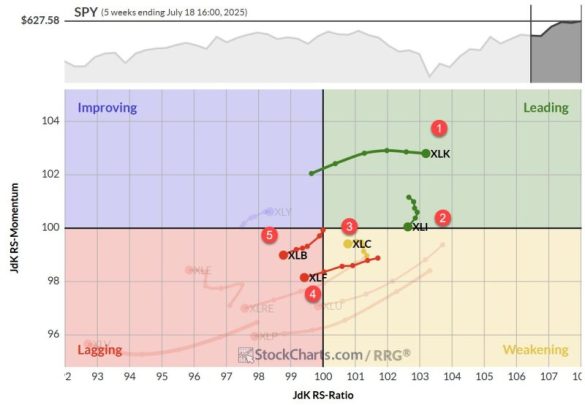

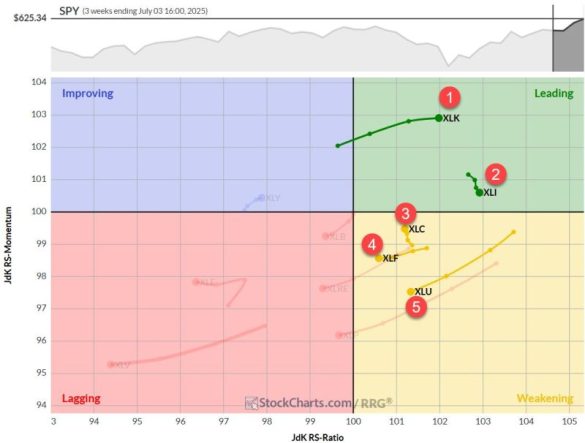

Sector Rotation Stalls, Tech Remains King Despite a slight rise in the S&P 500 over the past week, the sector rotation landscape is presenting an intriguing picture. For the first…

In this video, Mary Ellen spotlights the areas driving market momentum following Taiwan Semiconductor’s record-breaking earnings report. She analyzes continued strength in semiconductors, utilities, industrials, and AI-driven sectors, plus highlights…

Join Tom as he covers key inflation data, earnings season highlights, and sector rotation trends. He breaks down recent price action in major indexes like the S&P 500 and Nasdaq,…

Join Grayson as he shares how to streamline your analysis using custom ChartStyles. He demonstrates how to create one-click ChartStyles tailored to your favorite indicators, use style buttons to quickly…

Relatively healthy earnings reports from the big banks and a June inflation report that came in line with analyst expectations didn’t give the stock market much of a lift, as…

Join Dave as he reviews three common candle patterns traders can use to identify potential turning points. From bullish engulfing patterns to evening star patterns, Dave gives insights on how…

I remain very bullish and U.S. stocks have run hard to the upside off the April low with growth stocks leading the way. I expect growth stocks to remain strong…

Is the market flashing early signs of a shift? In this week’s video, Mary Ellen McGonagle breaks down the subtle but telling moves happening under the surface. From strength in…

Over a number of years working for a large money manager with a rich history of stock picking, I became more and more enamored with the benefits of scanning for…

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you’re probably wondering: Amid the current “risk-on” sentiment, even with ongoing economic…

Just when we thought tariff talk had gone quiet, it’s back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new…

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we’re seeing some interesting shifts within the…